It should be noted right away that today almost all European banks do not have any special restrictions on granting loans to foreigners. Formally, this is the case. But in practice, financial institutions are very reluctant to take on the risks associated with issuing a loan to a citizen of another country.

If you are a businessman and want to develop your business in Europe, you should try to get a quick loan from Fundshop https://www.gofundshop.com/. Here you can get the necessary funding within 24 hours.

In particular, it is much more difficult for a person with a Russian or Ukrainian passport to get a loan in Europe than for citizens of the EU countries. However, there are options, and if certain conditions are met, you can improve the chances and speed up the process of obtaining a loan from a European bank.

- A big advantage when applying for a loan is legal residence in the country, as well as the presence of a residence permit or permanent residence.

- Obtaining an official income, owning a business or carrying out entrepreneurial activities with the corresponding payment of taxes to the country’s budget will be a significant argument for European banks. By the way, a legal entity is much more willing to issue loans.

- In each case, you will have to prove your solvency and reliability, one of the options is to open an account with a creditor bank or purchase securities, which can be used as collateral and as a factor in reducing banking risks.

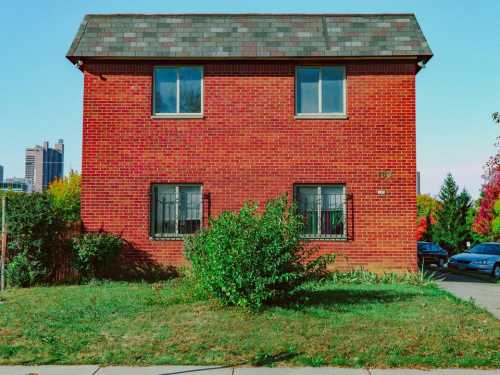

- If we are talking about a mortgage loan, then the property will be a collateral and, as a result, will increase the confidence of the bank.

- When you are in your home country, it is possible to take out a loan in Europe with the help of specialized consulting companies. Basically, through them, European banks provide their services, negotiate and conclude agreements with foreigners.

The above conditions are not exhaustive, but the most effective for obtaining a loan in Europe. Sometimes European banks may charge interest rates slightly higher for foreigners than for their citizens. On average by 1–3%, which in any case is not comparable with the level of rates in domestic banks. Loan amounts are usually very significant; in some countries, financial institutions will not want to get involved in a contract for less than 500 thousand euros.

Documents for applying for a loan in Europe

- Identity card (international passport);

- confirmation of the absence of debt or outstanding loans;

- information or certificate of income received;

- information on the availability of property that can be used as collateral;

In each case, the bank may put forward additional requirements, for example, a certificate of family composition, payment of taxes, origin of income, surety, and so on. More information should be clarified directly with the financial institution.

Types of loans and availability in different European countries

- The easiest way to get a mortgage loan in Europe . As mentioned above, the lending object serves as a collateral for the bank, which significantly reduces financial risks. It is quite possible to take a mortgage in Germany, Spain, France, Great Britain, Israel and Cyprus. Access to real estate is practically closed in a number of Eastern European countries with an unstable financial system, such as Bulgaria, Romania and Montenegro. Taking a mortgage in Switzerland is also not possible. The interest rate in mortgage lending varies on average from 4 to 6%. Loan term up to 30 years, with an initial payment of 30 to 60% of the value of the object.

- Consumer loan . This type of loan is available for foreigners with a residence permit or permanent residence in Europe . Banks very rarely issue consumer loans to non-residents living outside the country.The conditions for obtaining are almost the same as for native citizens. Legal income, positive credit history, business and real estate are encouraged. Interest rates are around 7-10%.

- Business loan . In Europe, they have a rather positive attitude towards foreign entrepreneurs. If an immigrant creates additional jobs, regularly pays taxes and contributes to the development of the country’s economy, then banking institutions are open to him.In some countries, for example, in Germany, state banking support for start-up entrepreneurs is developed. If you have an effective business plan, you can get a loan at a minimum rate (up to 3%) and a deferred repayment of the loan body and interest for up to two years.

Summing up, we can say with confidence that it is quite possible for a foreigner to take a loan in Europe. But only formally. To fully use banking services, it is better to live and work in a European country.